The demand for improved healthcare is rapidly expanding as a consequence of the high economic growth, the rising income per capita, increasing urban population, an aging population as well as the opportunities provided by healthcare insurance schemes.

According to the Asian Development Bank, Vietnam is in the top 3 countries with the fastest economic growth in Asia. This can be seen through Vietnam’s gross domestic product (GDP) increasing to 7.08% in 2018, the highest in the past 11 years. Strong economic growth, enhanced personal income and rising health awareness both favourable conditions for increased spending on healthcare in general.

Additionally, over the last two decades, Vietnam population has expanded from 72 million people in 1995 to over 95 million people8 in 2019 which has increased the market size. According to the World Bank, urban areas in Vietnam have developed spatially at 2.8% per year, among the fastest growth rates in the Asian region. In these contexts, the growth of a new urban middle-class will induce changes in community behaviours and consumption patterns and will positively affect the demand for healthcare and pharmaceutical products.

The Vietnam population officially entered an ‘aging phase’ in 20179 and is among the most rapidly aging countries in the world, which will force authorities to spend more money, to improve healthcare services to take better care for senior citizens. The proportion of older people in the total population has increased to 11.9%, and one in six people was over the age of 60 in 201710. As a result, public, provincial-level hospitals funded by the governments are undergoing upgrades of their facilities and opening new departments for specialty treatment. The government also aims to bring insurance coverage to 100% of the population by 2030,11 with additional initiatives also being developed to further enhance health care delivery.

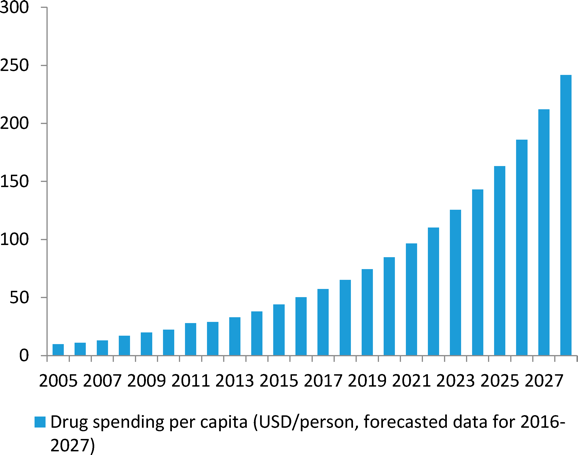

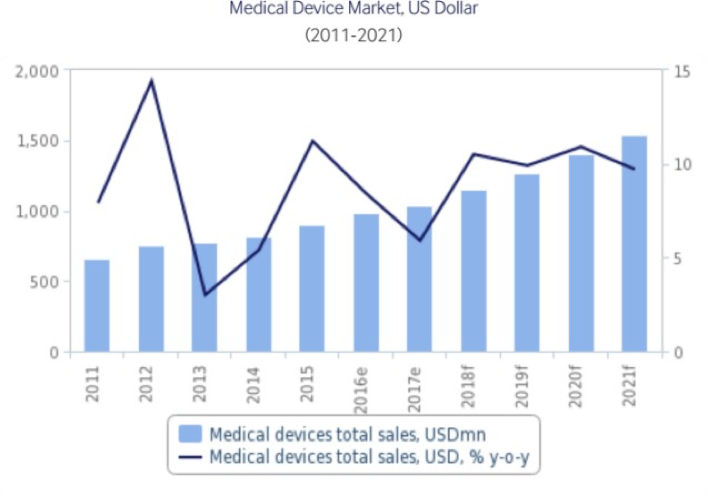

Such developments are creating new opportunities not only for medical devices but also pharmaceuticals producers in Vietnam. However, the local production of medical equipment and pharmaceuticals have not been able to meet demand. Local producers have only been able to supply basic medical supplies such as scissors, rubber health products, scalpels, hospital beds and other disposable supplies which according to MOH means 90% of medical devices in Vietnam need to be imported. In terms of pharmaceuticals, domestic drug firms focus mostly on producing generic products and other simple areas of drug production, as they lack research and development capabilities as well as the ability to invest in new compounds. Consequently, much of Vietnam’s spending on pharmaceuticals is on imports. The MOH data shows that the country’s drug imports last year increased by 8.8% year-on-year to US$3.7 billion. Therefore, the government is looking to the private sector to meet some of the demands being placed on the industry, designating healthcare as one of 17 sectors open to foreign investment in January 2016.

Tin liên quan

- Một số dự án mời gọi thầu cung cấp vật tư, thiết bị y tế ( cập nhật ngày 02,03/07/2019)

- Một số dự án mời gọi thầu cung cấp vật tư, thiết bị y tế ( cập nhật ngày 16-18/07/2019)

- Test kit xét nghiệm COVID-19 do Việt Nam sản xuất bán tự do ở châu Âu và Anh

- Leading Vietnam’s Healthcare sectors for US Exports and Investments

- Người nhập cảnh được kiểm soát Covid-19 như thế nào?